How to Improve Your Credit Score Quickly …

By Milton Stanley

Banks, Auto Dealers, Insurance and Credit Card Companies are NOT your friend!! But you probably already know this. These financial giants created the rules and the credit scoring game to their benefit. They do not care if you pay 10% or even 30% interest, in fact they prefer it.

Did You Know?

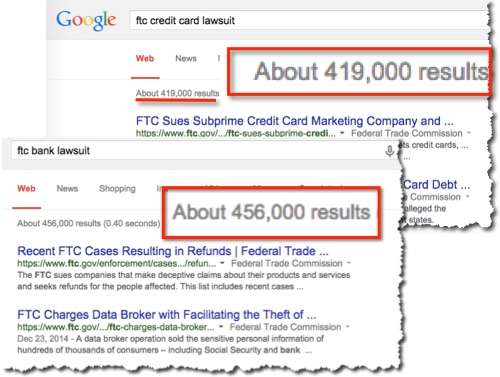

If you search google for “FTC Credit Card Lawsuit” or “FTC Bank Lawsuit” you will find over 1-million (1,000,000) combined results. The FTC (Federal Trade Commission) is a government agency who’s mission is “To prevent business practices that are anticompetitive or deceptive or unfair to consumers…”

The fact of the matter is banks and other financial institutions make more money when you fail to manage your credit scores. And they know that the majority of scores contain a large number of errors and this benefits them. The worse our score is, the higher interest and penalties you pay. Unfortunately it is your responsibility to manage this problem.

And credit card companies aren’t the only ones the benefit from your bad credit score. The credit reporting agencies themselves have been the subject of great debate for decades. Have you heard of the term “FICO” or “FICO Score” which is the formula used to determine your credit worthiness.

Did You Know FICO is a publicly traded company ?

Thats right. FICO is not just a term used for credit scoring, it is a publicly traded software company ( FICO was founded in 1956 as Fair, Isaac and Company – Wikipedia ). A company with billions of dollars in assets and shareholders who want to see them succeed (aka profit). The same is true for all three credit reporting agencies (i.e., Equifax, Experian, Trans Union).

These reporting agencies all make money by selling information about you (including personal information) to banks, credit card companies, auto dealers, employers, insurance companies and…. well.. anyone who will pay for this information. Here is the real “kicker”…

The Credit Bureaus make more money when your credit score is low!

Why? The answer is simple. Banks and other financial institutions charge higher interest rates to people with poor credit (defined as a score lower than 700). Higher interest rates can have massive benefits for lenders as they charge you more to borrow money. So.. if the financial institution can charge more, then your record (you and your financial history) is worth more and the credit bureaus can charge more for information about consumers with sub-standard credit (remember- these bureaus make money selling information).

It is such a problem that these Bureaus have been sued too!

May of 2014 FTC released a report recommending that Congress act to require greater transparency by data brokers. It cites an example of a data clustering technique that could be used by insurance providers as a sign of risky behavior. Of course, there was no evidence that it was being used in this manner.

Now you understand why credit scores and credit reporting are such a big deal. It is all about “The Money” and more importantly it is all about…

..Your Money!

I am sure you know that the real motivation of a bank or any financial institution is to profit from you, your money and even your mistakes. They are playing a game, writing the rules and even influencing the “referees” while you sit on the sidelines.

Yep, if you’re struggling with poor credit scores and debt issues then you are basically sitting on the sidelines. You need to get in the game, understand the rules and learn the techniques, tactics and legal strategies that help you win.

The credit games has rules and surprisingly, many of these rules are in your favor but you probably don’t know about them.

But It is Not Your Fault!

You are busy trying to live your life….go to school or work, feed the kids and just survive! These credit reporting companies and banks all know this too. They are confident that you aren’t paying attention and they are correct. Your busy life is understandable but now it is time to get in the game and play to win.

The good news is that these big companies have abused their power too many times. As a result, the government is continually monitoring them and changing laws to protect YOU. But it doesn’t help you, if you don’t know how to use these legal benefits. That is why I have compiled all the facts and action steps in a Free Guide. This guide will help you..

Understand The Rules and Loopholes in The “Credit Game”

So far I have spent most of this article trying to get you motivated. And to help you understand that you can order all the free credit scores and monitoring you want but that won’t help unless you can influence the outcome. In this free guide you will learn:

- -Avoiding common daily mistakes that reduce your credit scores

- -How to quickly and properly raise your credit score in 30 days

- -How to read your credit reports and where to get free copies

- -What you need to dispute and how to do it (includes checklists)

- -How to negotiate better interest rates.

- -How to re-establish credit when you’re starting from “zero”

- -And more..

You can download the guide free with no obligation or commitment from you. All I ask for is your name and email address in exchange. Why? Three reasons:

– Reason One: To send you updated information via email newsletter

– Reason Two: To gain your trust when it comes to credit information

– Reason Three: To offer a done-for-you service ( for those too busy to follow these steps)

There it is, the bold truth. Ultimately some small percentage of the people who download this free guide will choose to use our credit repair services but it isn’t required. You can do this all on your own by simply following the steps in this free guide. And if you prefer to have someone help you, that option is also available.